Then & There: Taxing Dogs 1796

By Richard Hooper

We think of April as a month of spring and rebirth, as well as tax month. It was also, in 1796, the month when John Dent introduced a bill before Parliament to begin taxing dogs in England.

Dogs running wild and uncared for attacked pedestrians, charged at people on horseback and created chaos for horses pulling carriages, resulting in serious accidents and even death. Accounts of people dying from the bite of mad dogs were frequently reported in the press. In addition to responding to issues of public safety for people, there was a desire to reduce dog attacks on sheep.

Great Britain was in dire financial straits at the time. It had outstanding debts resulting from the Seven Years War and the American Revolution, with new demands on finances accruing from the burden of a war against France. England had just gone through one of its severest winters on record and there had been several years of crop failures, resulting in food shortages and bread riots.

The primary purpose of the tax was not to raise revenue (although the timing could not have been better and the revenue produced most welcomed by His Majesty’s government). Rather, it was to reduce the size of the dog population. Nonetheless, it was debated as a tax: the groundwork for which had been laid out in a pamphlet written in 1791. In “An Address to both Houses of Parliament: Containing Reasons for a Tax on Dogs” George Clark argued for a tax based on the premise that, “the keeping of dogs is generally a species of luxury no one will attempt to deny.” The point was an important one, for it was generally considered that taxing luxuries was preferable to taxing necessities. As Clark continued in his pamphlet:

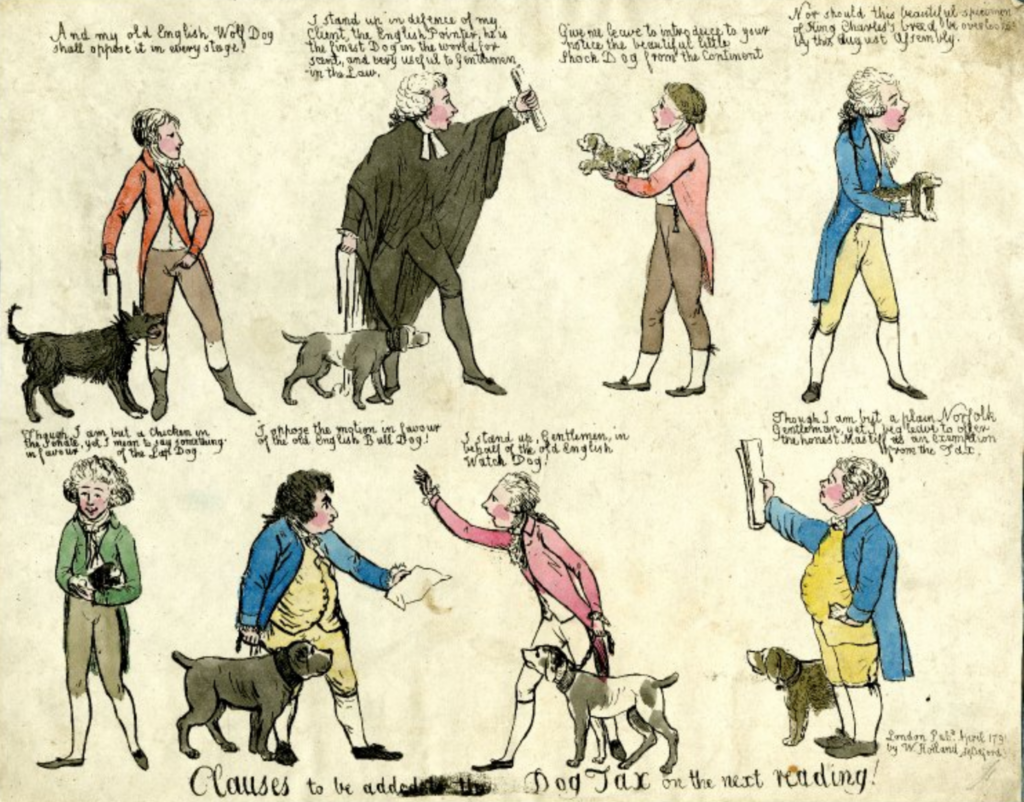

Clauses to be added to the Dog Tax on the next reading. Appeals to exempt favorite breeds from the tax. Courtesy the British Museum.

There are two principal reasons why luxuries should be preferred to necessities as subjects for taxation. The one is, that luxuries are generally in some degree pernicious, necessaries always harmless and useful. If therefore, either of them is to be burdened by taxes, that ought to bear the burden which is pernicious; that rather excused which is harmless and useful. It may indeed be doubted whether necessaries ought, in any instance, to be subjected to taxes, where there a possibility of raising money out of luxuries.

The other consideration is, that, in taxing luxuries, those sustain the greatest part of the weight who are best able to bear it, ie. THE OPULENT, for these deal most in luxuries: _____ THE POOR are seldom encumbered with them.

The nature of this thinking opened the door to a spirited debate as to whether dogs were a necessity or a luxury – a debate tightly entwined by the English class structure. One position was that poor cottagers were depriving themselves of food by keeping dogs, and that they needed to be protected from their own foolishness. Further, if others were paying for this privilege through parochial taxes, it was a luxury the poor could not otherwise afford. Therefore, it was immoral.

This argument was countered by the position that dogs owned by “the man in easy circumstances” as described by one parliamentarian, were either silly playthings for ladies or sporting dogs and hounds used by those who were lawfully qualified to hunt game, a small and privileged portion of the population. The vast expenditures that could be lavished upon these creatures, as well as the exclusive pursuits that they could be engaged in, spoke of luxury. That alone was reason enough for taxation. Further, the quantities of food that these pampered creatures could consume created shortages and drove up prices for the poor. That, therefore, was immoral.

When Dent introduced the bill, he introduced it as a flat tax. Each dog, regardless of owner or use, was to be taxed at the same rate. By the time the bill was voted into law, it had been transformed into a progressive tax.

Progressive taxes had been espoused by Adam Smith in his book “Wealth of Nations,” published in 1776. Smith was a professor of moral philosophy at the University of Glasgow, teaching ethics, politics and jurisprudence. His interests ventured into the ways economies influenced the fabric of society. He thus became the father of economics, with one of his major concerns being the accumulations of enormous fortunes controlled by a small percent of the population who had the influence to distort the role of government to meet their needs. He expressed his belief in progressive taxation, stating that, “It is not very unreasonable that the rich should contribute to the public expense, not only in proportion to their revenue, but something more than in that proportion.”

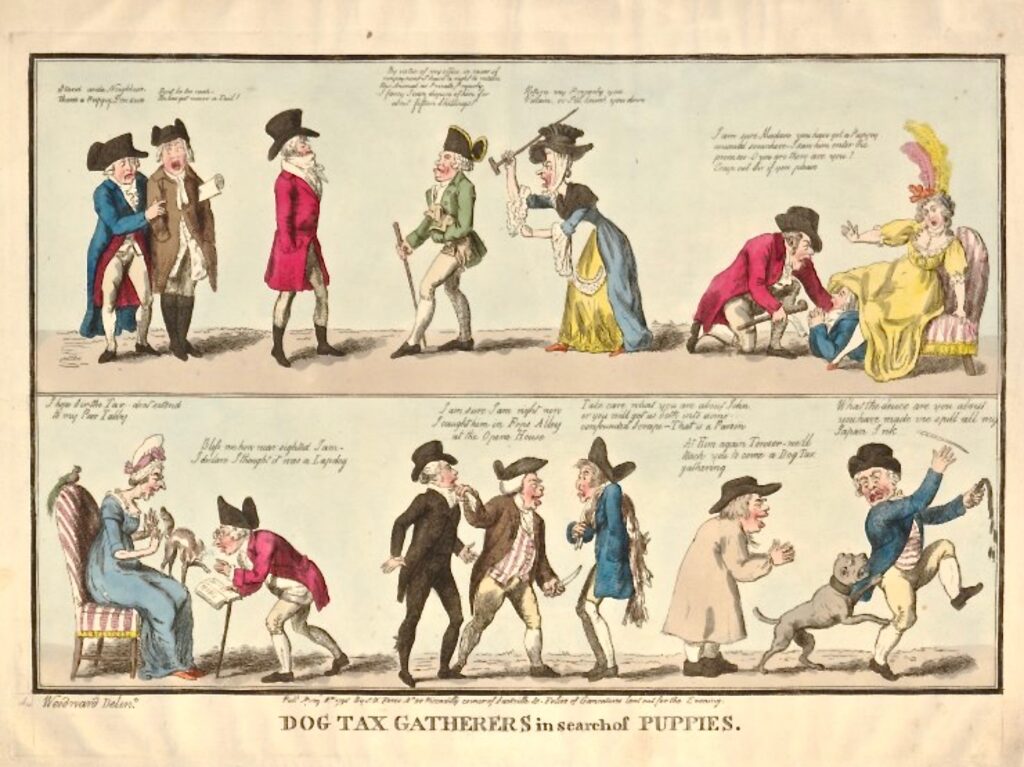

Dog Tax Gatherers in Search of Puppies. Courtesy the British Museum.

William Pitt, Chancellor of the Exchequer (who had already modified numerous taxes from flat to progressive) essentially controlled the dog tax bill through the debates, altering it from Dent’s original intent to have it fall the heaviest on the poorest economic classes, and molding it into a more progressive tax that became law. The emphasis was on dogs used in sport: hounds, greyhounds, spaniels, lurchers, setters, pointers, and terriers. Their use, which Pitt classified as a luxury, was restricted to a particular class. The tax on such dogs was five shillings per year for each dog. The tax was the same when two or more dogs were owned. The law taxed persons assessed for dwelling taxes who owned a single dog (not used in sport) at a reduced rate of three shillings. If more than one was owned, the rate increased. People living in dwellings not assessed could own a single untaxed dog. Packs (such as foxhounds and harriers) could be aggregated into a tax of 20 pounds.

The law had flaws, but in essence it concluded that large scale and restricted uses of dogs was a luxury, but to humbly own a single dog as a companion could be viewed as a necessity. It was a small turning point in the structure of the status quo – one that added a new thread of dignity to the fabric of society. ML

This article first appeared on April 27, 2020 at Middleburglife.com.